Easily View Statistics

Domestic REITs by the Number

As of January 2026

Number of Domestic REITs Managed

446REITs

As of January 2026

Asset of REITs under Management

KRW 117.74trillion

REITs Listed in the Domestic Stock Markets

KB STAR REIT , Hanwha REIT , KORAMCO THE ONE REIT , SamsungFN REIT , MASTERN PREMIER REIT , Shinhan GA REIT , SHSBREIT , MIRAEASSETGREIT , NHALLONEREIT , SK REIT , D&D platform REIT , ESRKREIT , KLI REIT , JR GLOBAL REIT , MAPS REIT 1 , IGIS RESIDENCE REIT , IGIS Value REIT , NH Prime REIT , LOTTE REIT , ShinhanAlphaREIT , E KOCREF , STAR SM REIT , KTOPREITs , A REITs

24REITs

Annual Average Growth Rate of AUM,

from 2002 to December, 2025

26.24%

Market Capitialization of the Listed REITs,

on January, 2026

9trillion 741.5billion

Average of Dividend Profit Rate of

Total REITs 2023 under Management

4.0%

(7.2% deducted from public interest policy-typed REITs with a low dividend yield)

Dividend Yield of the Listed REITs 2023

7.4%

(Market-based dividend yield of listed REITs in 2023 is 7.6%)

Overview of REITs

* Unit : billion won * Reference : Jan, 2026(Interim ag

| Classification | Number of REITs | Assets Under Management | Rate (%) |

|---|---|---|---|

| CR REITs | 25 | 3,234.7 | 2.8 |

| PR REITs | 6 | 382.4 | 0.4 |

EM REITs |

411 | 113,652.8 | 96.5 |

| SM REITs | 4 | 463.6 | 0.5 |

| Total | 446 | 117,741.5 | 100.0 |

Industry Size

Status of Annual REITs Growh and Asset Size

* Reference : 2025년 11월말 * unit: billion won

| Year | Increase of Number of REITs NoC |

Equilty | AUM | ||

|---|---|---|---|---|---|

| Newly Authorized | Authorized | Net growth | |||

| 2002 | 4 | 4 | 328.5 | 558.4 | |

| 2003 | 4 | 8 | 4 | 706.4 | 1,146.0 |

| 2004 | 2 | 10 | 2 | 801.4 | 1,436.0 |

| 2005 | 2 | 11 | 1 | 1,008.5 | 1,743.9 |

| 2006 | 4 | 14 | 3 | 1,046.3 | 3,329.6 |

| 2007 | 6 | 18 | 4 | 2,392.6 | 4,981.9 |

| 2008 | 5 | 20 | 2 | 2,774.3 | 4,872.4 |

| 2009 | 19 | 36 | 16 | 3,997.9 | 6,989.1 |

| 2010 | 17 | 50 | 14 | 3,659.7 | 7,631.2 |

| 2011 | 31 | 69 | 19 | 4,199.6 | 8,230.8 |

| 2012 | 18 | 71 | 2 | 5,400.2 | 9,529.1 |

| 2013 | 20 | 80 | 9 | 5,915.6 | 11,787.6 |

| 2014 | 27 | 98 | 18 | 7,047.8 | 14,968.2 |

| 2015 | 41 | 125 | 27 | 8,407.0 | 18,018.0 |

| 2016 | 57 | 169 | 44 | 10,734.4 | 25,092.8 |

| 2017 | 36 | 193 | 24 | 12,734.0 | 34,883.4 |

| 2018 | 36 | 217 | 24 | 14,534.2 | 43,900.9 |

| 2019 | 50 | 248 | 31 | 17,123.6 | 51,856.0 |

| 2020 | 61 | 282 | 34 | 21,692.4 | 65,270.1 |

| 2021 | 62 | 315 | 33 | 26,472.9 | 78,235.5 |

| 2022 | 55 | 350 | 35 | 31,642.2 | 89,871.8 |

| 2023 | 35 | 369 | 19 | 34,464.2 | 96,658.1 |

| 2024 | 49 | 400 | 31 | 35,797.7 | 100,076.5 |

| 2025 | 55 | 447 | 47 | 43,937.5 | 117,866.9 |

| 2026.1월말 | 0 | 446 | -1 | 43,865.5 | 117,741.5 |

Status of the Domestic Listed REITs

* Unit : billion won * Reference : 2026년 1월말(AUM 연결기준)

NoC

Market Cap.

AUM

Annual Dividend Yields

* Reference : 2024년

※ In 2007~2009, CR REITs were liquidaqted (reflecting real esate sales difference), and the average dividend t yields had reached a temporarily high. rate.

* Reference : 2024년

| Year | CR REITs | EM REITs | Listed REITs | Average Yields |

|---|---|---|---|---|

| 2002 | 8.5 | 8.9 | 8.5 | |

| 2003 | 6.6 | 7.1 | 6.6 | |

| 2004 | 8.4 | 8.7 | 8.4 | |

| 2005 | 12.2 | 11.9 | 12.2 | |

| 2006 | 12.1 | 10.1 | 11.1 | 11.9 |

| 2007 | 49.0 | 7.4 | 70.3 | 40.4 |

| 2008 | 40.3 | 6.3 | 93.8 | 28.0 |

| 2009 | 40.0 | 7.2 | 71.7 | 26.1 |

| 2010 | 10.4 | 6.4 | 9.9 | 8.6 |

| 2011 | 9.9 | 6.4 | 6.0 | 8.3 |

| 2012 | 9.4 | 4.9 | 3.7 | 7.1 |

| 2013 | 16.2 | 4.2 | 7.0 | 9.2 |

| 2014 | 9.4 | 4.6 | 2.8 | 6.2 |

| 2015 | 10.1 | 7.3 | 7.1 | 8.1 |

| 2016 | 7.0 | 5.8 | 3.1 | 6.0 |

| 2017 | 10.6 | 2.7(4.1) | 4.4 | 4.1(7.6) |

| 2018 | 15.8 | 2.8(6.4) | 11.1 | 4.4(9.2) |

| 2019 | 15.8 | 3.2(8.1) | 7.7 | 4.2(9.5) |

| 2020 | 23.2 | 4.3(10.2) | 7.1 | 5.5(12.0) |

| 2021 | 39.1 | 4.9(10.3) | 7.7(5.2) | 6.2(12.6) |

| 2022 | 12.3 | 5.0(9.7) | 7.8(6.4) | 5.2(9.9) |

| 2023 | 9.7 | 3.9(7.1) | 7.4(7.6) | 4.0(7.2) |

| 2024 | 8.4 | 5.6(7.1) | 7.5(8.1) | 5.7(7.2) |

※ The annaul average yields are equivalent to dividend yields (incluing liquidaqted REITs) as to average paid-in capital (equity capital + capital surplus)

※ Public interest Policy-typed REITs (public rental REITS, social priviate rental REITs ) suffer a fall in average yields by non-dividend, during the period of opeation. Thus, yields except policy REITs are reckoned separately in ( )

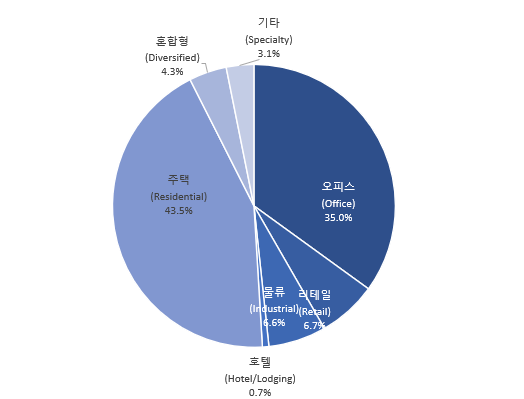

Portfolio & Dividends by Property Sector

* Reference : JAN, 2026

* Reference : JAN, 2026

| Classification | NoC | Asset Under Management | Market Share(%) |

|---|---|---|---|

| Office | 107 | 41,183.1 | 35.0% |

| Retail | 29 | 7,908.7 | 6.7% |

| Industrial | 44 | 7,788.3 | 6.6% |

| Hotel/Lodging | 10 | 868.0 | 0.7% |

| Residential | 221 |

51,217.9 | 43.5% |

| Diversified | 24 | 5,067.3 | 4.3% |

| Specialty | 10 | 3,707.9 | 3.1% |

| Total | 406 | 105,998.4 | 100.0% |

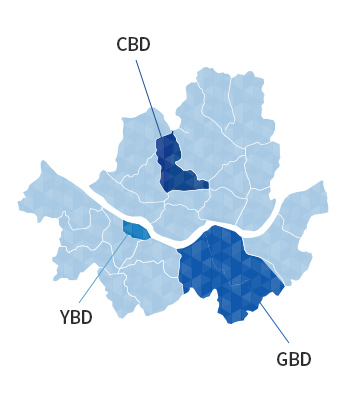

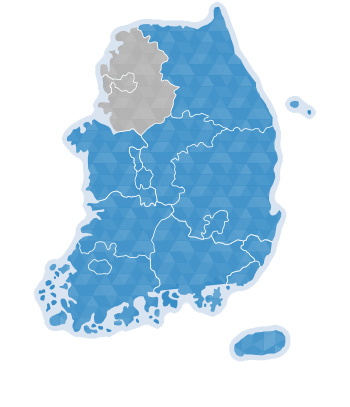

Performance by Property Location

Seoul

-

4,567.3

/ 4.4%CBD

Central Business District

-

5,657.9

/ 7.4%GBD

Gangnam Business District

-

1,873.1

/ 44.3%YBD

Yeouido Business District

-

4,919.7

/ 20.4%ETC

Except for Seoul

-

8,046.7

/ 6.2%Seoul

Metropolitan

Area -

2,113.4

/ 9.6%Regins

-

6,438.3

/ 5.8%Nationwide

Overseas

-

2,048.3

/ 6.2%

* Reference : Q3, 2021

| Classification | SM REITs | Seoul metropolitan | Regionl | Nationawide | Overseas | Total | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| CBD | GBD | YBD | ETC | |||||||

| EM REITs | AUM | 4,351.8 |

5,094.1 |

1,762.1 |

2,885.0 |

6,499.4 |

1,564.9 |

6,395.0 |

1,630.4 |

30,182.7 |

| Yield | 3.9% |

6.0% |

5.5% |

1.9% |

10.8% |

6.5% |

7.8% |

3.0% |

6.6% |

|

| CR REITs | AUM | 220.2 |

546.1 |

76.4 |

1,236.9 |

691.7 |

391.8 |

- | - | 3,163.0 |

| Yield | 296.5% |

17.9% |

7.1% |

223.4% |

16.0% |

5.8% |

- | - | 115.5% |

|

| Sum/Avg. | AUM | 4,572.0 |

5,640.2 |

1,838.4 |

4,121.9 |

7,191.1 |

1,956.7 |

6,395.0 |

1,630.4 |

33,345.7 |

| Yield | 18.0% |

7.2% |

5.6% |

68.4% |

11.3% |

6.4% |

7.8% |

3.0% |

16.9% |

|

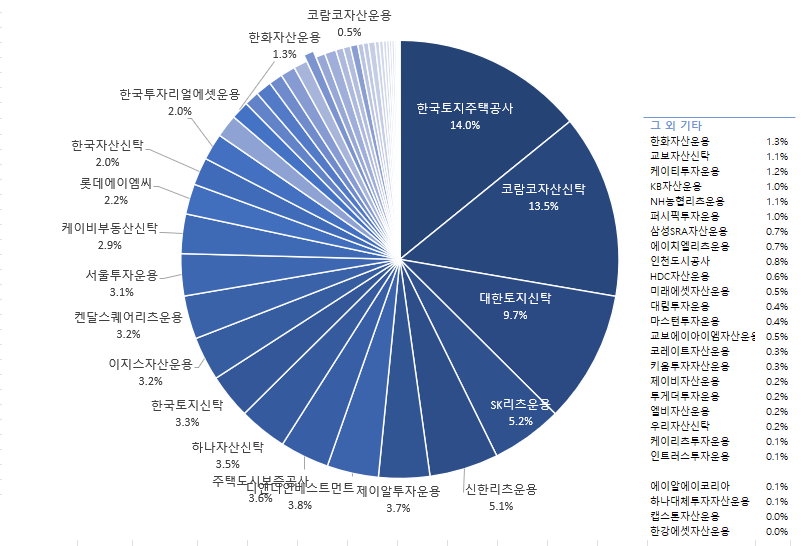

Asset Management Companies Report

* Reference : JAN, 2026

* Reference : JAN, 2026

| AMC | NoC | AUM | M/S |

|---|---|---|---|

| Korea Land & Housing Cprporation | 31 | 16,541.6 | 14.0% |

| Koramco Asset Management and Trust Co. | 44 | 15,843.8 | 13.5% |

| Daehan Real Estate Trust Co. | 65 | 11,401.2 | 9.7% |

| SK AMC | 4 | 6,146.1 | 5.2% |

| Shinhan Real Estate Investment Trusts Co. | 23 | 5,955.6 | 5.1% |

| D&D Investment | 27 | 4,449.6 | 3.8% |

| JR Investment Management Co. | 8 | 4,406.2 | 3.7% |

| HUG | 10 | 4,246.8 | 3.6% |

| Hana Asset Trust | 29 | 4,165.9 | 3.5% |

| KOREIT(Korea Real Estate Invesmtment Trusts) | 19 | 3,864.8 | 3.3% |

| IGIS Asset Management | 11 | 3,786.6 | 3.2% |

| Kendall Sqaure REITS Management | 4 | 3,743.2 | 3.2% |

| Seoul Investment Management | 12 | 3,626.8 | 3.1% |

| KB Real estate Trust Co. | 18 | 3,411.1 | 2.9% |

| Lotte AMC | 1 | 2,615.5 | 2.2% |

| KAIT (Korea Asset Investment Trusts) | 18 | 2,384.5 | 2.0% |

| KIRA(Korea Investment Real Asset) | 1 | 2,304.2 | 2.0% |

| Daishin Asset Trust | 8 | 1,976.5 | 1.7% |

| Hanwha Asset Management | 1 | 1,555.9 | 1.3% |

| KT AMC | 8 | 1,386.6 | 1.3% |

| NHREITs Management | 8 | 1,276.1 | 1.1% |

| Kyobo Asset Trust | 8 | 1,274.6 | 1.1% |

| KB Asset Management | 4 | 1,185.9 | 1.0% |

| Pacific Investment Management Company | 11 | 1,179.9 | 1.0% |

| IH | 5 | 979.5 | 0.8% |

| Samsung SRA Asset Management | 1 | 868.1 | 0.7% |

| Hanla REITs Management | 5 | 808.3 | 0.7% |

| HDC Asset Management | 3 | 656.5 | 0.6% |

| Koramco Asset Management | 2 | 641.9 | 0.5% |

| Mirae Asset Management | 3 | 620.4 | 0.5% |

| Kyobo AIM Asset Management | 1 | 571.3 | 0.5% |

| Mastern Investment Management | 5 | 454.2 | 0.4% |

| Darim AMC | 4 | 468.5 | 0.4% |

| KOREIT(Korea Real Estate Invesmtment Trusts) | 2 | 359.2 | 0.3% |

| Kiwoom Asset Management | 1 | 335.7 | 0.3% |

| JB Asset Management | 6 | 280.2 | 0.2% |

| Together Investment Management | 6 | 241.5 | 0.2% |

| LB Asset Management | 1 | 210.7 | 0.2% |

| Woori AMC | 6 | 218.2 | 0.2% |

| KREITs Investment Management | 3 | 147.7 | 0.1% |

| Hana Alternative Asset Management | 1 | 78.0 | 0.1% |

| Intrus Investment Management | 1 | 89.2 | 0.1% |

| ARA KOREA | 2 | 89.7 | 0.1% |

| Capstone Asset Management | 1 | 40.5 | 0.0% |

| HanmiGlobal Asset Management | 1 | 28.9 | 0.0% |

| AIM Investment Management | 1 | 27.0 | 0.0% |

| Shinsegae Property Investment Management | 1 | 0.3 | 0.0% |

| HeungKook AMC | 1 | 0.3 | 0.0% |

| Eugine AMC | 1 | 0.3 | 0.0% |

| Hangang Asset | 1 | 0.3 | 0.0% |

| Daol Asset Management Co. | (2020.06.11. 인가) | ||

| Heritage Capital Management | (2021.11.30. 인가) | ||

| Mugunghwa Trust Co.LTD | (2021.12.03. 인가) | ||

| VESTAS Investment Management Co. | (2022.05.20. 인가) | ||

| METHEUS Asset Management Co. | (2022.12.21. 인가) | ||

| Leading Asset Management Co. | (2023.02.06. 인가) | ||

| Bluecove Investment | (2023.06.27. 인가) | ||

| ADF Investment | (2024.02.28. 인가) | ||

| Welcome Asset Management | (2024.04.26. 인가) | ||

| Orion Capital Management | (2024.05.03. 인가) | ||

| GMCC | (2024.05.21. 인가) | ||

| GH | (2024.09.12. 인가) | ||

| D&O AMC | (2025.02.27. 인가) | ||

| United Partners Asset Management | (2026.01.19. 인가) | ||

| Sub-Total | 442 | 117,277.9 | 99.6% |

| Self-Management REITs | 4 | 463.6 | 0.4% |

| Total | 446 | 117,741.5 | 100.0% |

AMC Status Approved AMC

* Reference : 2026.01월말

| Year | Total AMC | New Approved AMC | Cancel/Withdrawal |

|---|---|---|---|

| 2002 | 4 | 4 | |

| 2003 | 6 | 2 | |

| 2004 | 6 | ||

| 2005 | 7 | 1 | |

| 2006 | 8 | 1 | |

| 2007 | 10 | 2 | |

| 2008 | 15 | 5 | |

| 2009 | 18 | 3 | |

| 2010 | 17 | 0 | 1 |

| 2011 | 21 | 5 | 1 |

| 2012 | 22 | 1 | |

| 2013 | 22 | 1 | 1 |

| 2014 | 21 | 1 | 2 |

| 2015 | 22 | 2 | 1 |

| 2016 | 25 | 4 | 1 |

| 2017 | 27 | 3 | 1 |

| 2018 | 29 | 5 | 3 |

| 2019 | 31 | 3 | 1 |

| 2020 | 36 | 6 | 1 |

| 2021 | 51 | 17 | 2 |

| 2022 | 56 | 5 | 0 |

| 2023 | 58 | 3 | 1 |

| 2024 | 63 | 8 | 3 |

| 2025 | 65 | 4 | 2 |

| 2026 | 66 | 1 | 0 |

※87 asset management companies were approved and 21 companies were cancelled and withdrawn from being authorized. A total of 66 AMC are being managed.