Why Invest in REITs?

Home > REITS Investment > Why Invest in REITs?

Merits of REITs Investment

-

High Dividend YieldsProviding dividend income similar to general stocks through steady cash flows that are not significantly affected by market conditions.

-

Liquidity (fluidity)After investing in REITs, it can be easily cashed in through the sale of stocks in the securities market to secure liquidity.

-

Asset Management Professionals

(professionalism)Operated by skilled and experienced real estate professionals -

Duty of Management, Supervision, and Notice (transparency)The basic data of investment judgment are transparently disclosed by disclosing the management supervision and quarterly investment reports of the Ministry of Land, Infrastructure, and Transport in the REITs information system.

Make a second salary using REITs

Listed REITs in Korea boast a noticeable dividend yield in the era of low-interest rates

with an annual average dividend rate of 7.4%(as of 2023).

A portfolio in which dividends are deposited every quarter can be formed through 23 listed REITs(as of 2024).

For example, if you invest 50 million won in listed REITs in Korea, you can receive about 3.70 million KRW in dividends over a year.

Recently, listed REITs are pursuing growth in scale through the incorporation of new assets,

so the stock price is expected to upwards, and the resulting profit margin can be secured as profits.

In addition, 9.9% separate taxation on dividends paid when purchasing REITs

and holding them for more than 3 years can be applied for three years.

Separate taxation can be applied through securities firms.

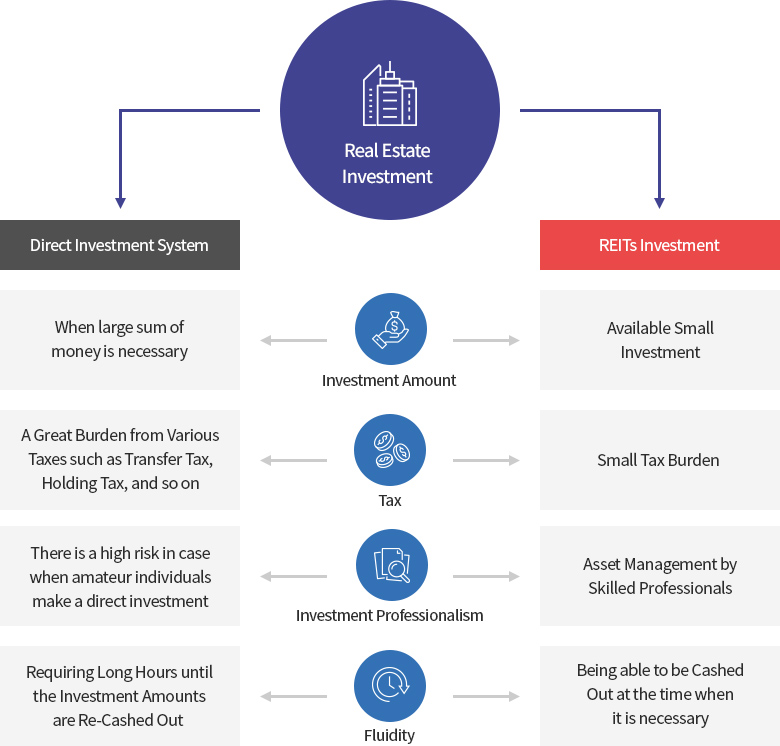

Merits of Indirect Investments against Direct Investments